Credit Card Debt & Finding Your Way to Financial Freedom

Credit cards are great for establishing your credit, getting cash back, and offering more protection than your standard debit card. However, credit card debt is a situation that captivates hundreds of thousands of Americans every year. According to Experian, overall U.S. credit card debt has eclipsed $800 billion (as of Q1 2019), with the average credit card debt per household climbing just over $6,000.

Credit cards are great for establishing your credit, getting cash back, and offering more protection than your standard debit card. However, credit card debt is a situation that captivates hundreds of thousands of Americans every year. According to Experian, overall U.S. credit card debt has eclipsed $800 billion (as of Q1 2019), with the average credit card debt per household climbing just over $6,000.

Because credit card debt is a prevalent issue in the U.S., here are a few scenarios to consider to help you become debt-free. It’s important to remember that the key for any of these scenarios is not to wait. The quicker you act, the quicker you can find your way to financial freedom.

Balance Transfer & 0% Annual Percentage Rate (APR)

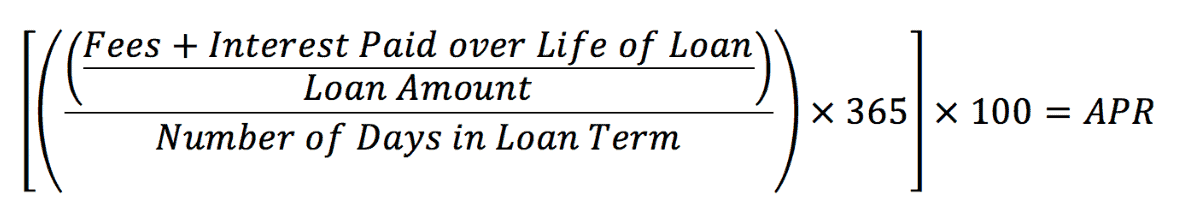

Do you know how much APR your credit card currently charges? APR is the yearly rate a credit card lender charges for borrowing. APR is expressed as a percentage, combining the total amount of interest payable plus the cost of any additional fees or charges, averaged over the term of the loan.

Source: https://www.creditkarma.com/advice/i/what-is-apr/

It’s commonplace to have a credit card with an APR between 16%-25%. If you’re paying off your credit card in full each month, the amount of interest your credit card charges shouldn’t matter. However, if you are simply making minimum payments at the time of collection, this can lead to a slippery slope of credit card debt if you’re not careful.

If you find yourself in credit card debt, one option to consider is getting another credit card. It seems counterintuitive to open another credit card if you’re already struggling to pay off one; however, some credit card companies will offer 0% APR for an initial period if you transfer a balance over to the new card.

In this situation, you could take the balance of your current credit card, transfer it to the new card, and then be able to take advantage of the 0% APR offer.

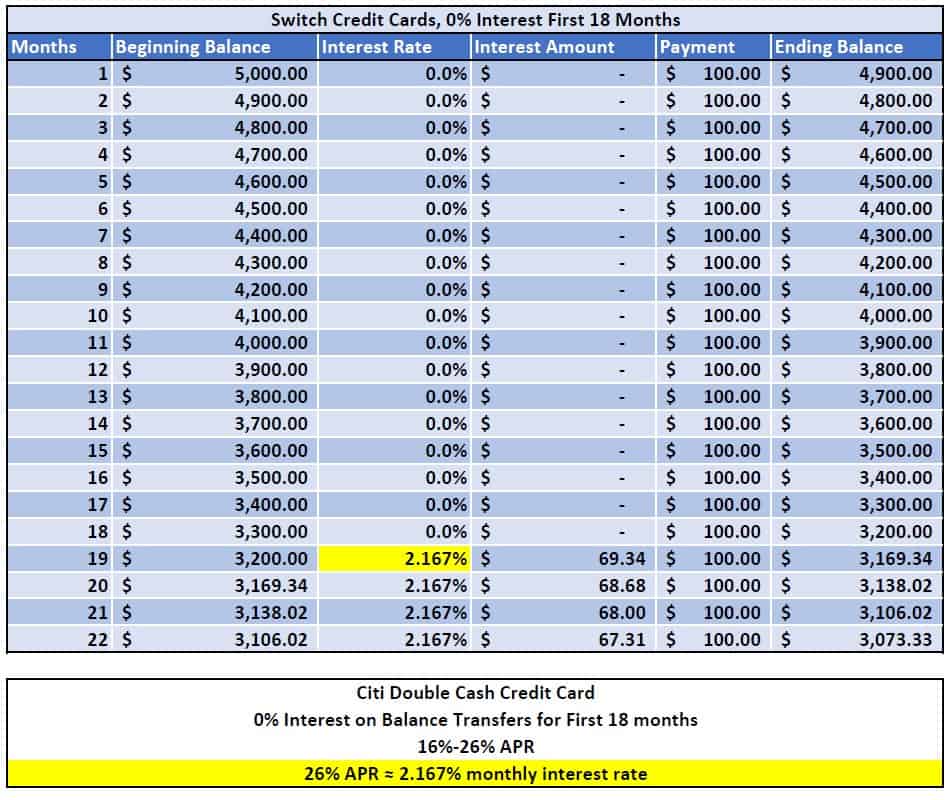

For example, the Citi® Double Cash Card offers 0% APR on any balance transfer for the first 18 months you own the card. This gives you a year and a half to aggressively pay down any debt with 0% interest, potentially saving you hundreds if not thousands of dollars. Below is a visual showing how much 18 months of 0% interest can help you.

By transferring your credit card balance to another card and utilizing the introduction period offering 0% APR, you’re able to take off $1,800 off your principal by applying $100 payments per month.

If you believe you can knock out the majority of your debt before the end of the 0% APR period, this is one of the best options for you.

Taking out a Private Loan & Paying a Lower Interest Rate

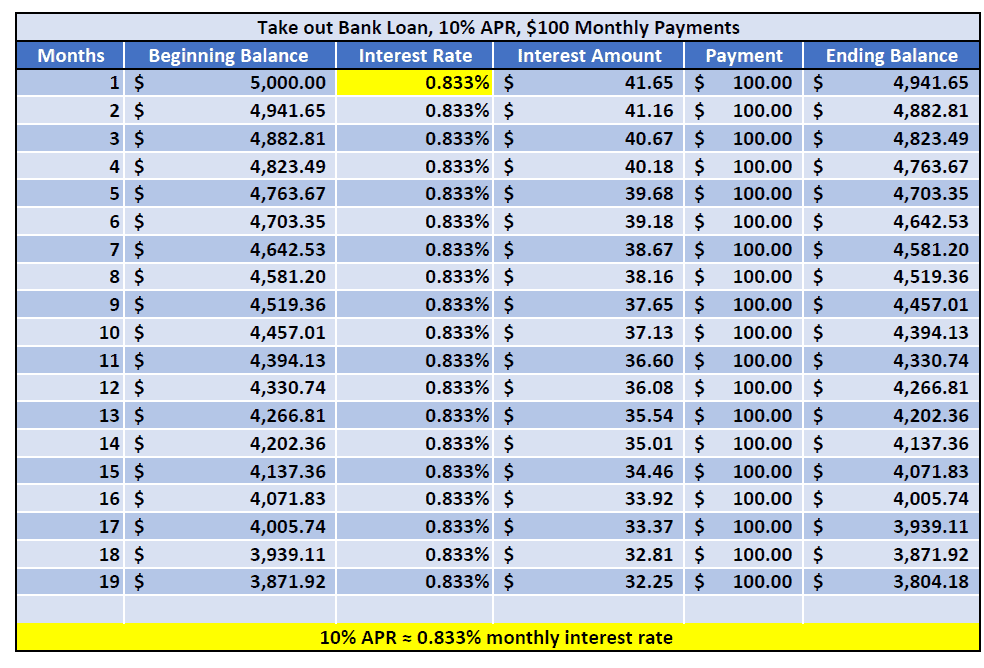

While not quite as lucrative as transferring your balance and taking advantage of a 0% interest rate for an initial period of time, taking out a private loan is another option to consider for paying down your credit card debt.

The key with this scenario is finding a loan with an interest rate that is lower than your credit card’s interest rate.

For example, the difference between 10% APR on a private loan and 26% APR on a credit card can be quite substantial. If you have a $5,000 credit card bill at 26% APR, the first month of interest charged would equate to approximately $108. Alternatively, that same $5,000 on a private loan at 10% APR would result in approximately $42 for the first month of interest.

If you have $100 per month to pay down your credit card debt, you would have a principal balance of $5,008 at the end of the first month with the 26% APR credit card rate. With a private loan at 10% APR, that same $100 payment would result in a principal balance of $4,942 after the first month.

Below is a visual representation of how 10% APR affects a $5,000 credit card bill, with the user making $100 monthly payments.

Again, this scenario is not as attractive as the 0% APR option, but it is better than keeping your card and allowing your debt to grow larger each month. If you need several years to pay off your debt, this is a great route to take so that you can lock in a lower APR.

Don’t Wait, Take Action That Will Make A Difference

You might actively be paying monthly installments towards your debt, but have you explored alternatives that could make that same monthly payment amount go further?

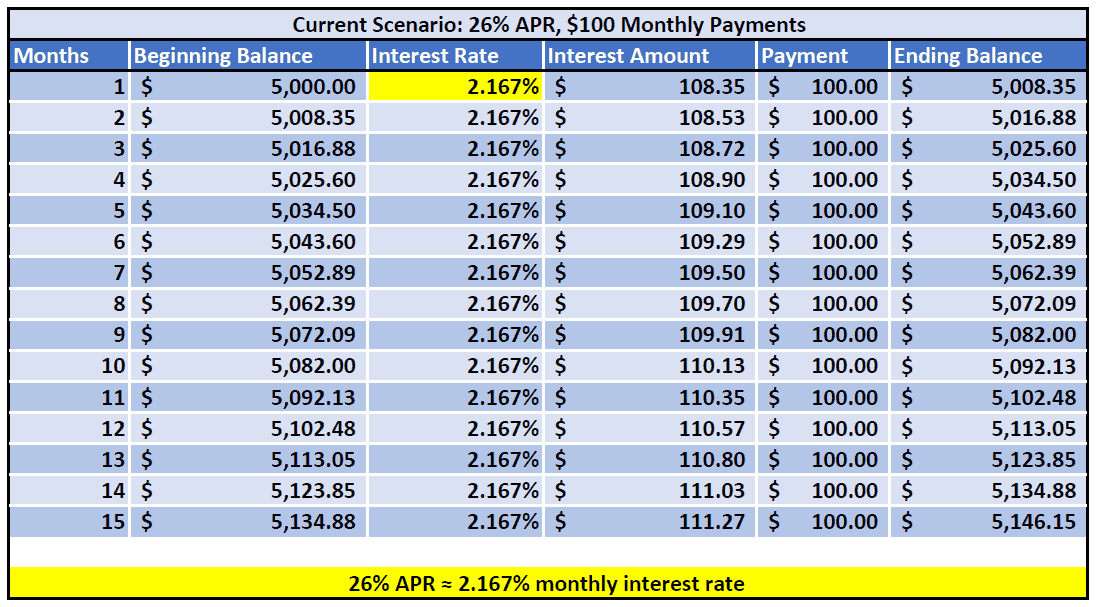

Below is an illustration of how a $5,000 credit card principal balance with a 26% APR grows month-to-month even despite paying $100 monthly.

In this scenario, the interest on a $5,000 credit card balance being charged 26% annually actually outweighs the $100 monthly payments being made, causing the principal balance to grow each month. After 36 months, you’ve effectively paid $3,600, yet are in even more debt than when you started.

The best thing someone with credit card debt can do is recognize the position they are in and take action to figure out how they can pay down their credit card debt quickly and effectively. Whether that’s transferring your balance to another card and taking advantage of the initial 0% APR period, taking out a loan with a lower rate, or increasing your monthly payments to draw down the principal balance, figuring out the best plan of action for your specific situation is the first step on the road to becoming debt-free.