The Greatest Threat to a Secure Retirement

As you approach retirement you should start to project your budget for the years ahead. You should have a pretty good handle on the income you will receive, as well as your outgoing expenses, such as food, hobbies, travel, etc. You may be starting to calculate your health and medical costs and find yourself getting stuck. How should you anticipate what these costs will be every year or in the future? On average, personal healthcare costs for the population aged 65 and older are 3 times higher than costs for those aged 65 and under and still working.¹

National health spending is projected to increase 5.8% per year. This is due to surmounting factors such as the Affordable Care Act health insurance coverage expansion and the increased cost of prescription drugs. From 2019 to 2024, spending is projected to further increase by 6.2% per year. However, this projection is only a glimpse of the overwhelming healthcare costs many retirees will actually face.² In fact, we anticipate expenses to be two to three times this projection.

Why do we think this?

Let’s take a look at the baby boomer population, defined as those that were born between 1946-to-1964. The U.S. Census Bureau conducted several studies and it forecasts that there will be considerable growth in the population of baby boomers over the next several decades. By 2050, this growing age group will be over 85 years old, which will ultimately change our country’s approach to healthcare for retirees.

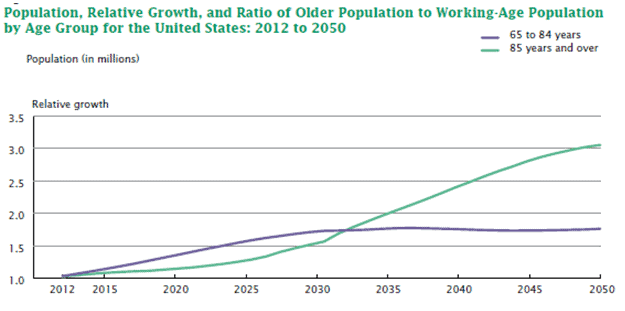

Figure 1 shows the number of people aged 65 to 84 will increase through 2030 and level off. However, the number of people aged 85 years and over is projected to continually increase. By year 2036, this group will have doubled and then tripled by 2049.

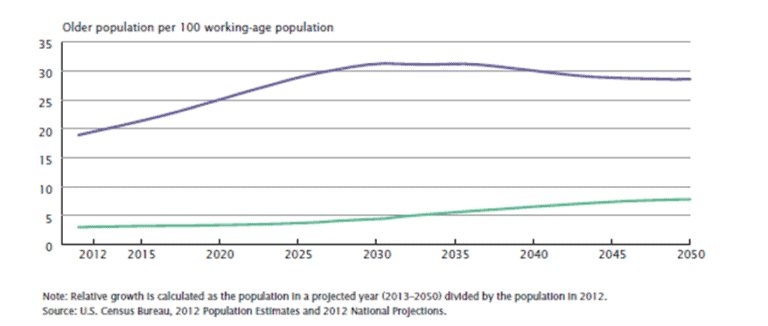

The second figure shows there are about 22 people aged 65 to 84 for every 100 working-age people (22:100). This ratio will increase to about 32:100 by 2030. This indicates the number of working-aged people will need to increase to support each

person aged 65 to 84. Both figures support that it is inevitable that the increasing life expectancy of this baby boomer age group will be one of the driving factors to rising healthcare costs due to medical, nutrition, and lifestyle needs.

As this population ages in this modern era, the trend is that more and more would like to age in place. Staying in their home rather than moving to a retirement community or nursing home allows retirees to feel more independent and safe. However, most are unprepared for the costs that are associated with retiring at home.

Today, the average cost of a 24-hour home health aide providing basic self-care tasks, including the six basic activities of daily living (excluding medical care) is $20/hour in the DC metro area. This equates to $480 per day for a single person or $960 for a couple.³ If we assume that home care costs will actually increase 8% (2.2% above predictions), in five years these annual costs will be over $521,950 for a married couple. In 20 years, 24-hour care could cost over $1,000,000 a year. We have found that most people do not have an adequate plan for this type of expense. This prediction is only for home health aide care and does not include medical care, prescription drugs, and home safety renovations.

How will medical care be affected?

The reality is that overhead costs for physicians have grown significantly due to tedious practice requirements, such as the Medicare reimbursement process4. This process is long and arduous and as a result, there is less time for these physicians to spend with their patients. Additionally, physicians and practices face rising reimbursement cuts. Smaller offices are forced to merge with larger hospitals due to inability to compete. As physicians join these larger organizations, they are becoming compensated based on productivity, which influences fee-for-service physicians to act more in the best interest for themselves and not the client. This means more copays, procedures and tests you may not necessarily need. Those with high deductible plans will have to pay for all or most of the basic healthcare services out of pocket. In addition, physicians are beginning to take fewer Medicare patients, which may force more people to look into alternative care pathways such as concierge medicine, telemedicine, or delay care until they are seriously ill.

Due to these factors, doctors are increasingly looking to adopt a new business model. Concierge medicine is a private practice where patients pay an out-of-pocket monthly or annual fee for access to care. One significant advantage of being a member of a concierge practice is the ability to see your doctor the same day you call. They generally spend more time with you, and are able to craft a more personalized wellness plan. The downside is the out-of- pocket membership fee. According to Bret Jorgensen, chair and CEO of MDVIP a national network of physicians with private practices, annual memberships for a single patient can range anywhere from $1,500 to $1,800 a year , depending on the market and physician. These costs will likely increase as the number of qualified physicians decrease and the concept of concierge medicine gains popularity. It is worth noting that the cost for concierge medical practice membership will be in addition to your other premiums, deductibles, and copays that are additionally needed. The reality is the average person cannot afford this service under the current healthcare system. The average person would rather use their discretionary income for other benefits such as long-term care insurance.

Each one of these challenges may be small, but together the magnitude can be significant. The future cost increases for healthcare needs are unpredictable, but inevitable. These costs can eat away at your savings and could use up a significant chunk of your retirement income. As financial advisors, one of our greatest concerns is our clients who will not be able to afford these overwhelming expenses without sufficient starting assets and growth. It is critical that we plan ahead for these unavoidable expenses.

Here are some questions to ask yourself and self-evaluate your current situation:

- How are your assets protected? Do you have enough life and long term care insurance coverage for your family in the event of your death or disability?

- How are your assets allocated? Asset allocation determines most of your return and risk.

- Are the assets you have accumulated going to sustain your future expenses?

- Do you have the proper legal documents in place in the event of your death or disability?

- Does your financial advisor act objectively in the best interest of his or her clients?

- Is your expected rate of return sufficient to support a long and active life and cover healthcare expenses?

Without any changes to the current healthcare model, the pressure on costs could lead to system-wide financial disaster as more Americans are living longer lives and need more expensive care.

Not having a plan in place or sufficient assets to cover long-term care expenses, coupled with increasingly large out-of-pocket expense for healthcare, can derail retirement and could lead to you becoming a burden on loved ones. Furthermore, as you age and are less capable of managing your own affairs, continuity of advice and guidance of investment management is imperative. It is our responsibility as your advisor to proactively develop this plan for you, as this is an essential component of the retirement planning process. ■

By Alina Lee, CFP®, NSSA®